Cranbrook, BC (March 1, 2022) – Council approved the City of Cranbrook 2022-2026 Five Year Financial Plan Monday night, which is a 1.75% general tax increase and 1% dedicated road tax for the 2022 Capital Roads Program, for a total 2.75% tax levy increase.

It was Council’s focus throughout the COVID-19 pandemic to limit financial burdens on taxpayers while still looking ahead and planning for the future.

It was Council’s focus throughout the COVID-19 pandemic to limit financial burdens on taxpayers while still looking ahead and planning for the future.

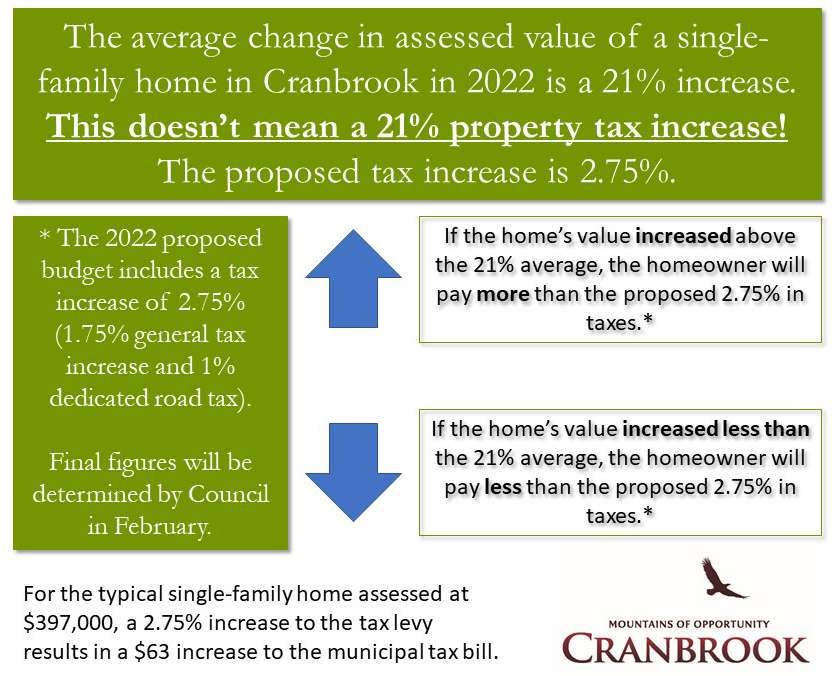

B.C. Assessment notices mailed at the beginning of the year, showed that the typical assessed value of a single-family home in Cranbrook increased from $327,000 in 2021 to $397,000, based on the new 2022 value. The 2.75% increase to the tax levy results in an average $63 increase to the municipal tax bill.

Those residents whose assessment increased more than the average will see their taxes go up more than 2.75%. Conversely, if a residential property owner’s assessment was below the average 21% increase in Cranbrook, the property owner would see less than 2.75% of an increase in their annual property taxes.

Cranbrook’s total tax increase of the combined 1.75% tax increase plus the 1% road tax is lower than most other comparable communities in British Columbia in 2022. Below is a list of municipalities that have publicly proposed the following tax increases:

- Campbell River (3.13%)

- Kelowna (3.64%)

- Creston (3.65%)

- Salmon Arm (4.00%)

- Squamish (4.10%)

- Lake Country (5.88%)

- Kimberley (4.71%)

- Terrace (5.52%)

- Penticton (5.70%)

- Vernon (6.88%)

The City’s 2.75% tax levy increase pertains only to the municipal portion of a property owner’s tax bill. A residential homeowner may see a larger increase dependent on the varying tax rates established for School District 5, the Regional District of East Kootenay (RDEK), Kootenay East Regional Hospital District (KERHD), and B.C. Assessment.

The approved 2022-2026 Five Year Financial Plan is available on the City’s website - https://cranbrook.ca/our-city/city-departments/finance/budget/.

Cranbook

Cranbook