Cranbrook, BC (March 26, 2025) – Administration will be bringing forward the proposed 2025 - 2029 Five Year Financial Plan bylaw, resulting in a tax levy increase of 6.40% in 2025. Council requested that this bylaw come forward to a future meeting for consideration.

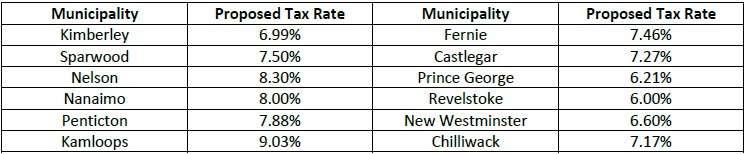

Inflation has impacted municipalities as it has households across Canada. In comparison to a number of other municipalities who have publicly reported their proposed tax levy increase for 2025, the City of Cranbrook is well below the average of 7.29%:

*Click here or on the chart above for a list of BC local governments who have publicly announced their proposed tax levy increases for 2025

In May 2024, Council directed Administration to target a 5% increase for the 2025 tax levy - a difficult challenge as the increase for 2025 was initially budgeted to be 8.59% and did not include increased costs and reduced revenues that were not known when the Five-Year Financial Plan was adopted in February 2024. To achieve 5% would mean reducing the City budget by almost $1.3 million. Since the Five-Year Financial Plan was adopted, additional cost increases and revenue reductions in excess of $800,000 were confirmed. These new budget pressures would have pushed the 2025 tax levy increase to almost 11%.

From the spring through the fall of 2024, City staff performed an exhaustive review of every expense and revenue source in all City operations to find savings and identify revenue opportunities. Service types and service levels were evaluated for costs and numbers served, cost recoveries through new or increased fees were evaluated, efficiencies were identified, fee structures were examined for completeness and compared to market, staffing roles and schedules were analyzed for efficiencies, and community support payments were assessed.

As an important part of this year’s budget process, Council directed staff to conduct a survey for residents to learn about the budget challenges and to provide their feedback on the 2025 budget. The survey, conducted from September 18, 2024 to October 18, 2024, was two-pronged in its approach – a statistically valid survey and a public opinion survey to consider options to reduce taxes to the target, or below, set by Council. Results from the Budget 2025 citizen survey were presented to Council on November 20, 2024. The survey was to determine public opinion on the options to reduce service levels, eliminate services, raise fees, find new revenues, or a combination of all these options. Through this survey, the budget process was able to get underway with a very clear understanding of the community's views early in the budget process, rather than near the end.

“A lot of work has been done and continues to be done by the Administration team. In response to Council’s direction and the feedback from the public survey, user fees have been increased, shifting funding for services towards a user-pay model away from more traditional heavy tax subsidization. Operational expenses have been reviewed in detail across the corporation, leading to more streamlined operational costing,” says Charlotte Osborne, Director of Finance. “Several pilot projects are underway or will begin shortly to evaluate ways to further reduce costs across the corporation especially around operations and services that are cost-inefficient (low use, high cost).”

“Council considered a further reduction of the 1 percent dedicated road tax to help reduce the proposed tax increase closer to 5 percent, but given the attention needed to our roads, Council felt it was best to keep that in,” says Mayor Wayne Price. “The result of the many months of hard work reviewing every expenditure and revenue possibility, is a proposed 6.4% tax levy increase for 2025. This important work by Council and staff needs to be acknowledged.”

Administration will be bringing forward for three readings the proposed 2025 - 2029 Five Year Financial Plan bylaw, resulting in a proposed 2025 tax levy increase of 6.40% for Council consideration at an upcoming meeting.

Cranbook

Cranbook