Cranbrook, BC (November 26, 2025) – With vital community input into the City’s budget process through the recent Budget 2025 Citizen Survey now in the hands of Council, work on the budget can get started with a clear understanding of public sentiment early in the process instead of near the end.

Results from the survey were presented to Council on Wednesday, November 20, as part of the first public budget meeting. You can review the complete survey final report @ https://cranbrook.ca/our-city/city-departments/finance/budget-2025-citizen-survey-final-report.

The survey conducted from September 18 to October 18, 2024 was two-pronged in its approach – a statistically valid survey and a public opinion survey to consider options to reduce taxes to the target or below set by Council. The survey looked to determine public opinion on the options to cut service levels, cut services, raise fees, find new revenues beyond what has been done to date, or a combination. 1600 randomly selected residents were mailed a survey to complete, with 409 surveys completed giving the survey a response rate of 25.6%. The public opinion survey, which was available to everyone on the City’s website had 1122 responses. In comparing responses from both surveys, the results were found to be very much the same.

The survey was one of the most in depth and detailed budget-related public consultation efforts ever undertaken by the City. This information will help inform Council over the next few months as they work on what promises to be a challenging budget, which will require some very difficult decisions.

“Lots of great ideas and good feedback were provided by residents in the survey responses, which we were very happy to have, and I want to thank everyone that participated in the budget survey. It’s going to take us some time to work through the input over the next few months,” says Mayor Wayne Price. “Council discussed the earlier goal of a 5% maximum tax increase and decided that with all the public input, Council first has to work through that feedback with the departments over the next few months before finalizing a budget and tax increase. There will be a number of ideas discussed that residents may hear about, but it’s important to understand that nothing has been finalized yet as ideas for changes in services and budgets are discussed at Council meetings. There is still a lot of work to do both by Council and by Administration through the winter and the spring before a final tax rate is set.”

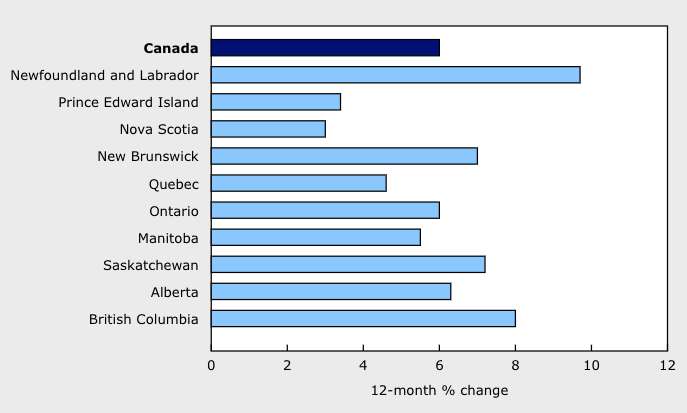

This year's budget process is also a particularly challenging year due to the inflationary cost pressures, which was outlined in the survey itself and has been presented at Council. Cranbrook is very much not alone in this issue of the inflationary costs affecting tax rates, with recent news reports and data from Statistics Canada highlighting the tax pressures being faced in BC and in Canada, with the average property tax increase in BC sitting at 8%.

Photo credit: Statistics Canada

Two more public budget meetings are scheduled before the end of the year, one on Wednesday, December 11 from 12pm to 7pm and Friday, December 13, 2024 from 1pm to 5pm. These meetings will be held in Council Chambers at City Hall and are open to the public. Both meetings will also be livestreamed at www.cranbrook.ca/livestream.

Moving forward, departments will be making presentations on their budgets during both the December 11 and 13 meetings, which will use information and budget changes made at the staff level to reduce costs to date, along with any reductions directed by Council at Monday’s meeting on City services and service levels.

Into the New Year, both Council and staff will work together to align the budget and services directed by Council through several iterations to finalize the 2025 budget and City Business Plan, which is required to be completed by the spring of each year.

Cranbook

Cranbook