Cranbrook, BC (February 9, 2023) – The City of Cranbrook will need to increase its property tax rate by about 5.87% once the 2023 budget and five-year financial plan is adopted later this spring.

This proposed tax rate is lower than the BC Consumer Price Index (CPI) as of December 2022, which was 6.9%.

The City is experiencing inflation just like everyone else. The cost of fuel has risen dramatically; diesel fuel, which powers our plows, garbage trucks, and equipment, as an example, now costs nearly double what it did in 2021. Just as your household heating, electricity and grocery costs have jumped, so has your City’s buildings heating and electrical costs, along with things like parts, pipes, lumber, asphalt, concrete, and other building materials to maintain City infrastructure and roads.

The typical assessed value of a single-family home in Cranbrook increased from $396,000 in 2022 to $446,000 in 2023. Based on these updated values, provided by BC Assessment, a 5.87% increase in property taxes results in a $155 increase to the municipal tax bill from 2022.

Cranbrook’s proposed tax increase sits, on average, in the middle of the pack compared to other communities in British Columbia in 2023. Below is a list of municipalities that have publicly proposed or adopted the following tax increases:

- Prince George 7.58%

- Terrace 10.33%

- North Cowichan 5.6%

- Squamish 8.90%

- Castlegar 6.65%

- Kelowna 3.80%

- Salmon Arm 3.83%

- Vernon 4.79%

- Nanaimo 7.30%

- Fort St. John 9.00%

- Duncan 9.57%

The City’s 5.87% tax levy increase pertains only to the municipal portion of a property owner’s tax bill. A residential homeowner may see a larger increase dependent on the varying tax rates established for School District 5, the Regional District of East Kootenay (RDEK), Kootenay East Regional Hospital District (KERHD), and B.C. Assessment.

The proposed 2023-2027 Five Year Financial Plan will be available on our website or picked up at City Hall in March 2023, with an opportunity available for additional public comments and feedback.

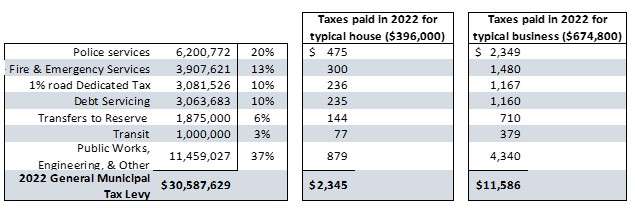

Tax Rates

It is difficult to compare municipalities solely on one variable like tax rates. Every municipality is unique.

Differences in levels of service between municipalities is a big reason why tax rates between communities can vary so much. Each community has different amounts of roads to maintain; some have roads to plow and sand to put down while some do not. Some municipalities provide volunteer fire services while others have full-time staffed fire departments. The number of RCMP members contracted to serve a community will impact the cost of policing services. Communities of similar size don’t necessarily need the same number of police officers. The types of services paid for by the general tax collected, will also impact the tax rate. In Cranbrook, for example, 10% of the general tax you pay is for capital road improvements. That same road tax in other communities may not be included in their general tax rate but in a frontage tax, which is a different type of tax.

Some municipalities have sources of revenue not available to others. Fernie, Sparwood and Elkford, as examples, are parties to the Elk Valley Property Tax Sharing Agreement. Under this agreement, the City of Fernie received $2.8 million in 2021, representing 25% of their tax levy. The City of Cranbrook does not have access to that kind of external revenue.

Many communities have significant major industry properties, which contribute substantially to the municipal tax base. Williams Lake, as an example, has a major industry tax rate as high as $111 per $1,000 of assessed value. The City of Cranbrook does not have a significant industrial base like Williams Lake, and relies heavily on residential taxation.

Cranbook

Cranbook