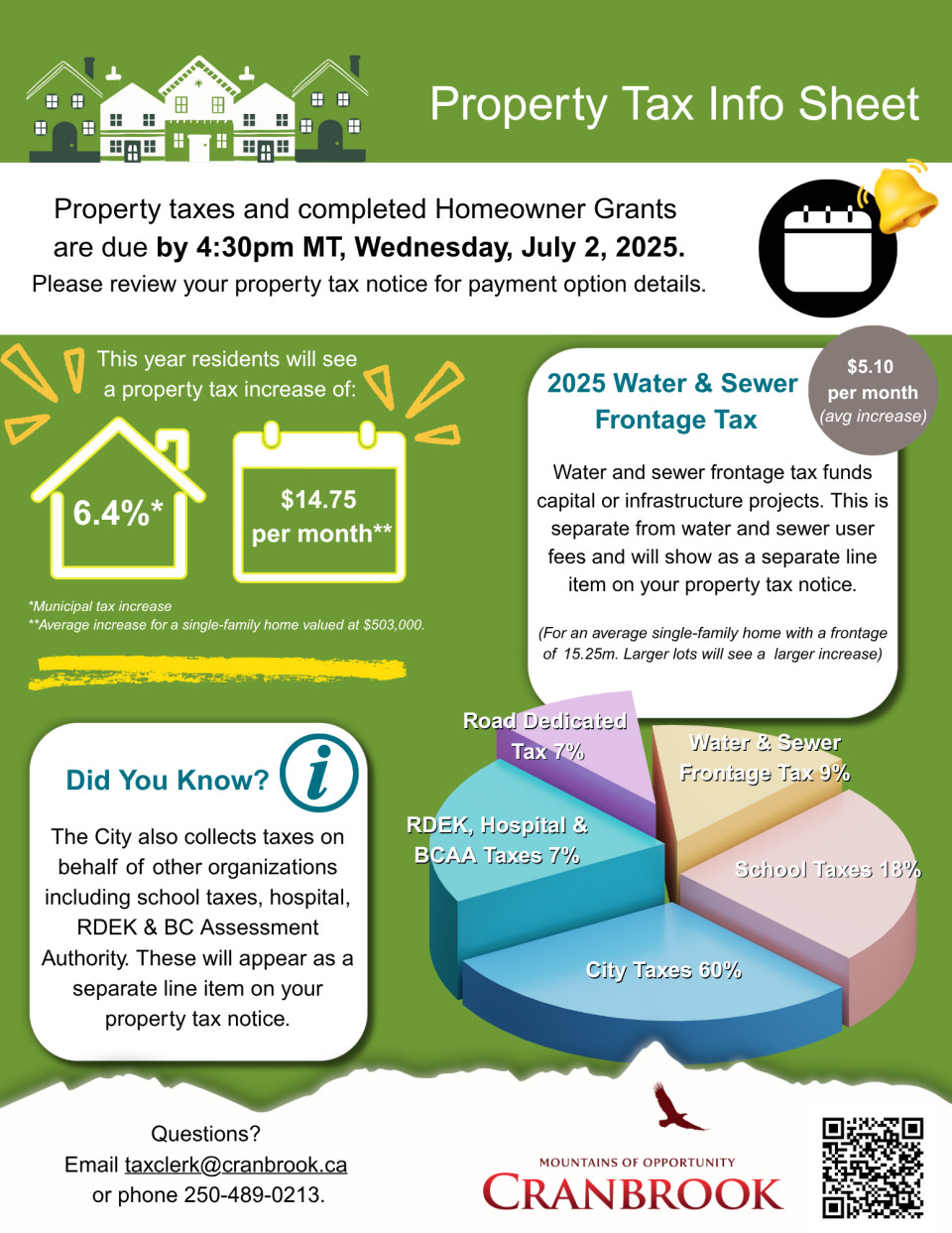

Property owners in Cranbrook are required to pay taxes based on the value of their property. Property taxes are levied and collected by the City of Cranbrook. The City is also responsible for the collection and distribution of taxes for the Province (school taxes), Regional District of East Kootenay, Kootenay East Regional Hospital District, BC Assessment and Municipal Finance Authority (MFA). The City uses tax revenue to support municipal services, projects, and infrastructure – which helps maintain Cranbrook’s overall quality of life. The City also provides water, sewer, and garbage collection services for residents.

Upcoming Property Tax Due Date: July 2, 2026

Property tax payments and Home Owner Grants must be received on or before July 2, 2026.

A 10% penalty will be applied to all current unpaid taxes and outstanding balances due to unclaimed Home Owner Grants (HOG). The penalty is a provincially legislated requirement and cannot be reversed for any reason, including not receiving your tax notice.

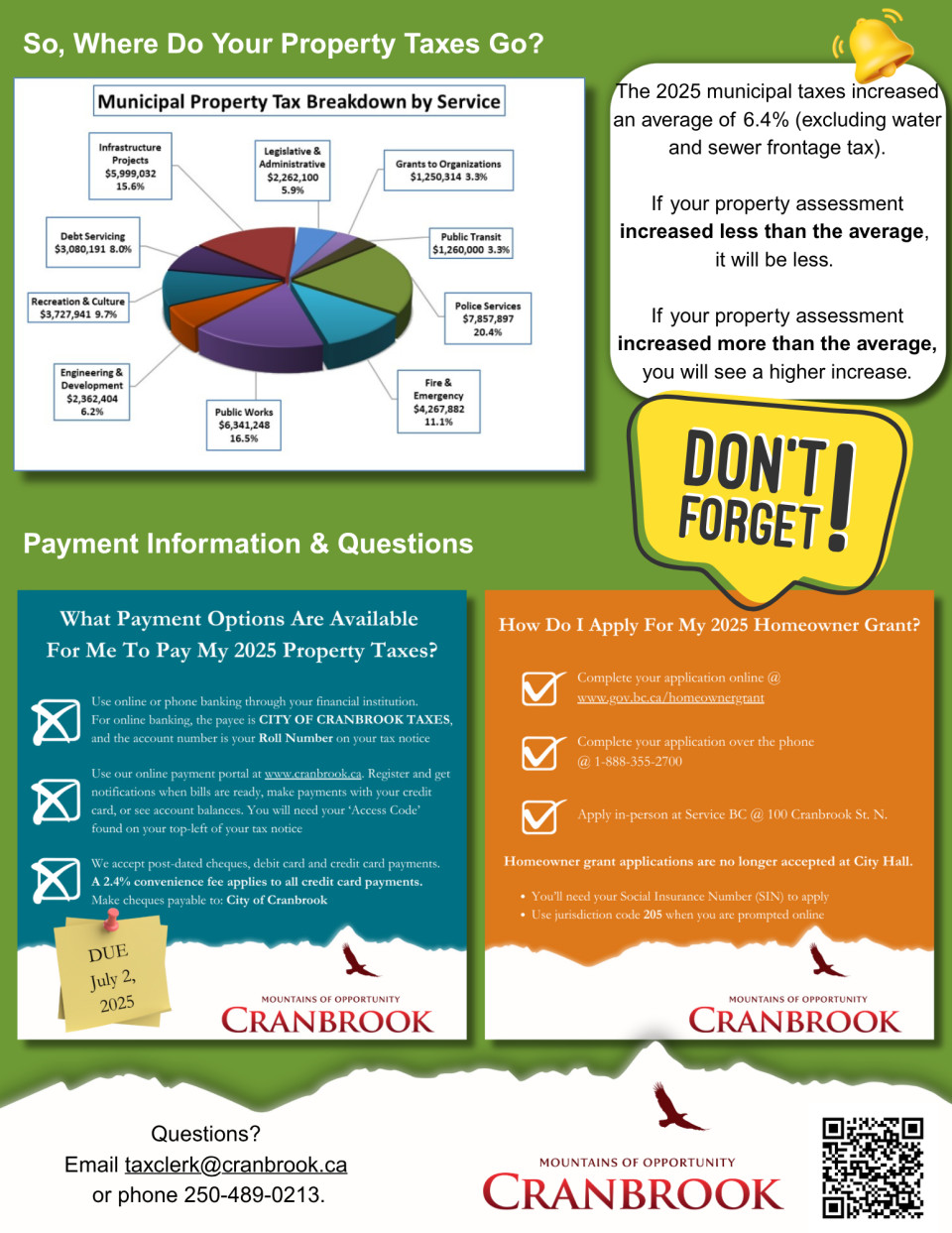

Home Owner Grant

Homeowner Grant applications must be submitted online through the Provincial website (https://www2.gov.bc.ca/gov/content/taxes/property-taxes/annual-property-tax/home-owner-grant), or by phone (1-888-355-2700). Homeowner grants can also be applied for in-person at the Service BC office located at 100 Cranbrook St. North. Homeowner Grant applications are not accepted at Cranbrook City Hall. This is a very simple process, only takes a few moments, and could save you hundreds of dollars on your property taxes!

Property Tax Deferment

Tax deferment is a low interest loan program that helps qualified B.C. homeowners pay their annual property taxes on their principal residence. It allows qualified homeowners to delay when they pay their taxes, reducing the financial burden to pay property taxes in the short term. You may qualify if you are 55 years of age or older, a surviving spouse or a disabled person as defined by regulation or, financially supporting a dependent child under the age of 18. For more information about Property Tax Deferment from the Province of BC, visit https://www2.gov.bc.ca/gov/content/taxes/property-taxes/annual-property-tax/property-tax-deferment-program, or call 1-888-355-2700. Note: Applications and renewals for property tax deferment can only be submitted online through eTaxBC.

There are two tax deferment programs you may qualify for:

Regular Deferment Program

- 55 years or older, or widow/widower, or a person with a disability as defined by Regulation; and

- 25% equity position in your home (based on the current year BC Assessment property value)

Families with Children Deferment Program

- Sign a declaration that you are financially supporting a child under the age of 18 at any time during the calendar year; and

- 15% equity position in your home (based on the current year BC Assessment property value)

Before applying for any of these tax deferment programs, you must pay all penalties, interest, previous years’ property taxes, and utility charges, as these charges cannot be deferred.

Payment Options

City Hall

Making payment in person at City Hall, non-cash payments are preferred. We do accept post-dated cheques, debit card, and credit card payments. A 2.4% convenience fee applies to all credit card payments. Make cheques payable to: City of Cranbrook.

Online Banking

Payment may also be made by telephone/online banking and through most financial institutions. For online banking, the payee is CITY OF CRANBROOK TAXES, and the account number is your roll number found on your Tax Notice. This is important to ensure payment is applied to the correct tax account. Please ensure your online payment details are correct!

Online Services

We offer an online payment portal where you can register to receive notifications when bills are ready for viewing. You can view account balances and make payments using credit card only. Register for this service here. You will need the ‘Access Code’ found on the top-left hand side of your Tax Notice underneath the address portion. Please note a 2.4% convenience fee applies to all credit card payments.

Prepayment Of Property Taxes

If you are currently participating in the pre-authorized payment program, please note that the prepayment amount on your Tax Notice includes the June 15th payment. As your prepayment amounts were based on an estimate, there may still be a balance owing. You are responsible for paying any amount outstanding on your Tax Notice. It will not be automatically withdrawn from your account. To avoid a penalty, please review your Tax Notice carefully and make sure you pay any outstanding balance prior to the due date each year.

Any overpayment on the current year property taxes will be applied to the first payment(s) for the next property tax year.

If you are interested in enrolling in the monthly pre-authorized payment plan, please contact the Finance Department at 250-489-0233 or email [email protected] to obtain an application form.

Monthly tax payments are withdrawn from your bank account by pre-authorized debits on the 15th of each month, starting in July of the current taxation year for the next taxation year. As an example, payments for 2026 property taxes begin on July 15, 2025.

Payment must be received in the City of Cranbrook bank account BEFORE the deadline. Online payments can take up to 5 business days to be processed by your financial institution.

**Click on either of the images above to open in a PDF file**

Cranbook

Cranbook